CA Attorney General Writes Biased Title & Summary for $12.5 Billion ‘Split Roll’ Property Tax Hike

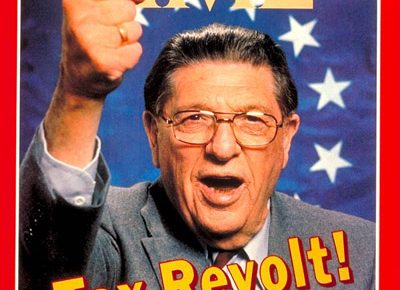

Anti-Proposition 13 special interests have already qualified one ballot measure for the November 2020 statewide ballot that would dismantle the 1978 ballot initiative’s property tax protections, and are currently gathering signatures to qualify a slightly more appealing sounding second version....